Things to Know About Bad Credit Loans

Bad credit means a low credit score or a limited credit history. Issues such as missed fees or maxed out credit cards can negatively affect your credit score.

Bad credit loans are an alternative for...

Find Out How to Plan for Job Loss

Have you ever been laid off from your job? Job loss is can be extremely debilitating, and it's a truly scary experience, especially if you don't have a savings set up to sustain you...

Easily Manage And File Claims With The State Farm Mobile App

Insurance claims can be some of the toughest processes that you have to go through. Finding a platform where you can easily file and manage claims isn’t just convenient but, oftentimes, is necessary. That’s...

Best Children's Educational Videos For Mobile Phones And Tablets

In today’s world, children can use and comprehend technology at a very young age. It is not hard to find a two-year-old who can operate a smartphone and get to their favorite app even...

The Simplest Step by Step Guide to Financial Planning

In good times and bad times, thick and thin, successful people always set goals. They recognize the importance of thinking ahead, and this always behooves them.

They will always make sure they follow through with...

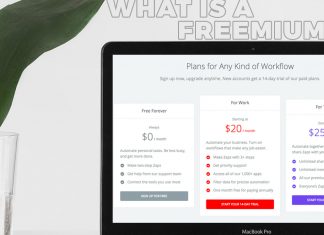

What Is a Freemium, and Who Offers Them?

Wherever you look today, it seems that freemium plans are just about everywhere. As a matter of fact, over the past decade or so, it appears that freemium has become one of the most...

LATEST

A Brief Guide to the IRS Tax Audit

For many Americans, just the thought of filing taxes can induce anxiety, especially as many see taxation laws and the process of filing complicated....

How To Buy Discounted Tickets With Skyscanner

Saving is one thing that almost everyone wants to do at some point in their lives. Whether for future purposes or for short term...

Save Money With These Do-it-Yourself Car Maintenance Tips

Having and taking care of a car is like taking care of a small baby. After paying a lot for your car, you want...

Deliveroo Jobs: Define The Modern Food Market

With the current COVID-19 pandemic, one thing has been clear, the need for home deliveries has certainly gone up. The market was swelling even...

Discover The Free WiFi App To Find Free WiFi On Your Phone

The tech world is fast-growing and keeps on improving as every day passes. By now, there is an app for nearly everything. These apps...

How To Pull In Side Money When You're Sent Home Sick From Work

Have you found yourself in a situation where you can’t work because of an illness? Have you been put on a forced leave due...

These Are The Most Reputable Home Insurance Companies

Nothing is as devastating as paying your home owner’s policy only to be told that whatever you were paying for did not give you...

Apps That Help You Make Money During Your Travels

These days, it seems there is an app for almost everything. There is even an app that rewards you for the number of steps...

The 4 Biggest Mistakes That Keep You From Thriving in Your Personal Life

Are you feeling unsure of your life? Have you found yourself in a situation where you are always comparing yourself with others? That could...

How to Manage Money While You're Still Young

When you are young, saving might seem like it’s impossible. It might be easy for you to look at your paycheck as a way...

5 Tips for a Sustainable Business

Most businesses have no understanding of what sustainability means. A sustainable business is one whose actions and purpose are equally grounded in environmental, social,...

Financial Tips for Wannabe Home Owners

Owning a home is the American Dream. However, buying a home is not an easy decision, and the process is definitely not easy.

The first...